Disclosure: I am not a financial advisor, and everything covered in this article is only my opinion. This article might contain affiliate links, so when you click on them to make a purchase, I might earn a small commission without costing anything extra to you.

Effective from September 22, 2025, Indians might have had sleepless nights due to a revamped GST 2.0, Goods and Services Tax (GST) regime.

The new tax regime focuses on reducing tax on essentials, while imposing strict rules on “sin” goods. Thus, promising both relief and challenges.

But what about the digital and affiliate marketing industry, specifically affiliate marketing? Let’s unveil the new GST cut rates and the GST impact on the affiliate marketing industry.

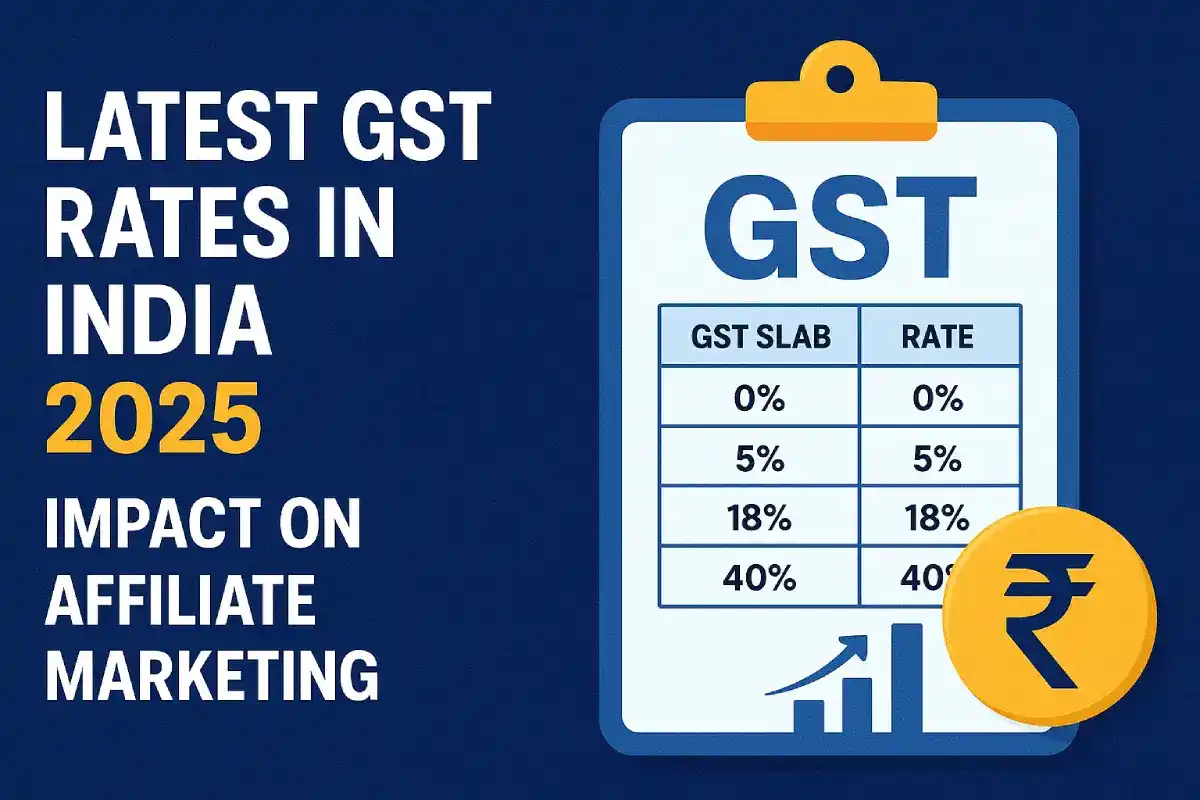

The New GST Rates: What Has Changed

At its 56th meeting, the GST Council decided to rationalise multiple slabs into a leaner structure. The new regime retains three core slabs, viz.: 0 %, 5 %, 18 %, along with a special 40 % rate on certain luxury and sin goods.

What are Sin Goods?

Goods that can cause harm to human health or society are termed as Sin goods. Some examples are Tobacco, Alcohol, Gambling, and Betting.

The former 12 % and 28 % slabs have been largely cut out (except specific legacy exceptions). Below is a summary of how some items are being slabbed.

Some notable shifts/examples:

- Cement, earlier at higher rates, is now taxed at 18 %.

- Select cosmetics, salons, and wellness services are now at 5 %.

- Electronics such as large TVs, fridges, etc., move from higher slabs to 18 %.

- Premium cars above a certain size/cost now attract 40 %.

Check out the complete GST cut rates along with the HSN code here.

Why the Change? Immediate Effects Expected

The new tax regime can be viewed as a “Navratri gift” from the government to the Indians. Thus, projected to inject demand into the economy.

With the Diwali celebrations nearby, analysts expect a boost in the purchase of appliances, electronics, automobiles, and other household items.

The drawback is that some goods, especially luxury and sin goods, will now cost more due to falling under the new 40 % slab.

GST 2.0 Impact on Affiliate Marketing

Nothing changes for affiliate marketers, digital marketers, content creators, influencers, and bloggers unless they are aware of compliance.

GST Rate on Affiliate / Commission Income

- The standard GST rate for affiliate marketing services (i.e., commissions earned) is still 18 %.

- Commission and brokerage services more generally are explicitly taxed at 18 %.

- Similarly, income sources such as YouTube, sponsored content, and affiliate income are subject to 18 % GST (9 % CGST + 9 % SGST) if applicable.

Does this apply to an Amazon affiliate or a TikTok affiliate?

TikTok is banned in India, so there is no chance of joining the TikTok Shop affiliate program. However, an Amazon affiliate is free to join without any GST requirement on the affiliate side. But earnings are subject to taxes, and TDS is automatically deducted.

Check out the Amazon Great Indian Festival and shop for any products with heavy discounts.

When Does GST Registration Apply To Affiliates?

Affiliate marketers must pay attention to when they cross GST income thresholds or engage in interstate/international transactions.

- Turnover threshold: GST registration becomes mandatory when the affiliate income exceeds INR 20 lakh in a financial year.

- Inter-state or export of services: Even if turnover is less than 20 Lakhs in a financial year, if services are supplied interstate/internationally, registration may be needed.

- Zero-rated export: Affiliate income from foreign (non-Indian) entities may qualify as “export of service” under GST, meaning a 0 % rate. This is subject to conditions and proper documentation (e.g, form W8-Ben, etc.)

Affiliates can register voluntarily even below the threshold, and can claim input tax credit (ITC) on eligible expenses.

Legal & Compliance Considerations

- Disclosure and transparency: Affiliate marketers are required to add an affiliate disclosure on their websites. This shows the audience that they might earn a commission when someone clicks and buys the product/service.

- Invoicing and accounting: If registered, they must raise valid GST invoices and regularly file GST returns (monthly, quarterly, or yearly.

- Penalties for non-compliance: If you are required to register (due to turnover exceeding INR 20 Lakhs or interstate services) but did not, you face penalties. This might include fines, interest on unpaid tax, or even higher penalties for evasion.

Opportunities & Risks

- The simplification of GST slabs may reduce ambiguity for top affiliate marketers dealing with tangential services or physical goods (e.g., affiliate-driven sales of goods) because many goods fall into fewer slabs.

- For affiliates working with global merchants or cross-border programs, zero-rating offers a tax arbitrage (i.e., no GST outflow), but only if compliance is rock solid.

- On the flip side, stricter enforcement may lead to audits or scrutiny, particularly if income scales or cross-border dealings are significant.

Summary

The GST 2.0 reform that came into effect on September 22, 2025, simplifies the tax regime, thereby reducing the burden on essentials. The new tax slabs now are (0 %, 5 %, 18 %, and 40 %), eliminating the 28% tax slab forever.

Do affiliate marketers need to pay taxes in India?

The tax regime for affiliate marketers remains the same at 18 % (service tax). As per the Goods & Services Tax, income exceeding INR 20,00,000/- in any financial year is liable to pay tax.

Is affiliate marketing legal in India?

Yes, affiliate marketing is legal, but affiliates should adhere to the terms and conditions of the affiliate programs and networks. Utmost care should be taken while promoting Gambling affiliate programs and sin products.

![BigSpy Review [year]: Best Ad Spying Tool 2 bigspy review](https://affreborn.com/wp-content/uploads/2022/12/bigspy-review-320x200.webp)

![My Honest Push.House Review [year] (Best Push Ads Network) 3 push.house review](https://affreborn.com/wp-content/uploads/2023/08/push-house-review-320x200.webp)

![XM Affiliate Program Review [year] XM Referral Commissions, Payouts & Global Reach 4 xm affiliate program review](https://affreborn.com/wp-content/uploads/2025/08/xm-affiliate-program-review-320x200.webp)

![WazirX P2P Exchange Review [year]: Is It Free and Reliable? 5 wazirx p2p review](https://affreborn.com/wp-content/uploads/2022/06/wazirx-p2p-review-320x200.webp)

![AdTargeting Review [year]: Best Keyword Targeting Tool 6 adtargeting review](https://affreborn.com/wp-content/uploads/2022/10/adtargeting-review-320x200.webp)

![HostGator Review [year]: Best Shared Hosting Up To 70% OFF 7 hostgator review](https://affreborn.com/wp-content/uploads/2020/03/hostgator-review-320x200.webp)