Payoneer Review

-

Easy of Use

-

Flexiblity

-

Transfer charges

-

Support

Try Payoneer For International Payments

Payoneer is the best alternative to PayPal for transferring international funds in local currency. You can get paid from your international clients in your bank account via Payoneer with real-time transfer charges.

Pros

- Easy to transfer international payments.

- Supports local currency.

- Zero fees for VAT.

- Automated Digital FIRC.

Cons

- Charges 3% on a credit card on all currencies for receiving payments.

Are you looking to send or receive international payments? If yes, then read the Payoneer review to get more information on how to save on international payments. In this article, I am presenting my honest Payoneer review that simplifies international payments for everyone.

Have you set up an eCommerce business and want to get payments from cross-border?

You can empower your business internationally by receiving cross-border payments with Payoneer. You just have to create a Payoneer account and start your business by receiving international payments in your account. Sign up to Payoneer by entering your business details in minutes and you are good to go.

Table of Contents

Payoneer Introduction: What is Payoneer?

Payoneer is a world-class platform to request international payments in your account with no huge fees charged, unlike your bank accounts. It is the local bank account that enables you to receive international payments in over 150 currencies including USD, EUR, CAD, AUD, JPY, MXN & more.

But when it comes to receiving international payments, the big question that bombards everyone is “Is Payoneer Safe and trustworthy?” More than 4 million customers around the world trust Payoneer to receive payments from international clients.

Customers who trust Payoneer include businesses, eCommerce stores, and freelancers worldwide. It doesn’t matter which country you are located in, Payoneer supports over 200+ countries & territories. Till now, the total estimated cross-border payments processed by Payoneer have reached 20 billion and there’s no end to it.

Over 1500 employees work globally in over 21 offices located globally. Payoneer customer service is overwhelming and supports over 35+ languages in-house. Founded in 2005 in New York City, the company has come a long way by introducing an automated system like tax calculation and more.

How does Payoneer work?

Your hard-earned money should not be wasted by paying huge transaction fees and this is what Payoneer cares about. No hidden fees, and no heavy transaction charges!

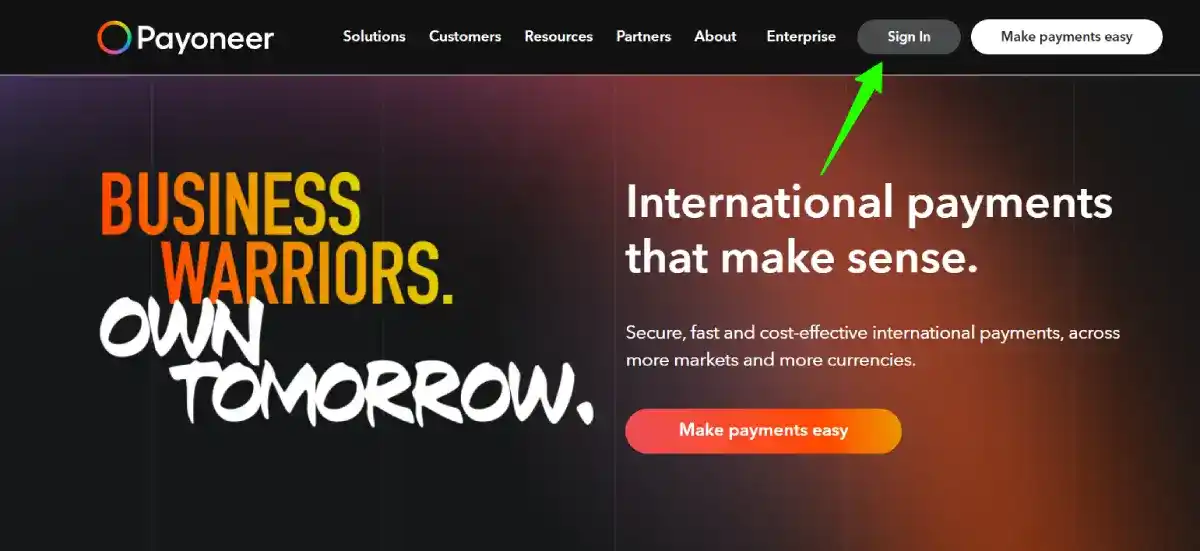

Payoneer lets you keep your money safe in your account. After registering, you can sign in to the Payoneer account and start sending/receiving money with a fast, simple, and flexible platform.

Solutions offered by Payoneer

This section of the Payoneer review will brief you about the world-class solutions offered to you for convenient fund transfers worldwide. The demand in need is simplifying international transactions and choosing Payoneer is the smartest choice that you can make just like other 4 million customers.

Don’t expect anything less when creating an account with Payoneer. Here are the dynamic solutions offered to its customers located in every corner of the world.

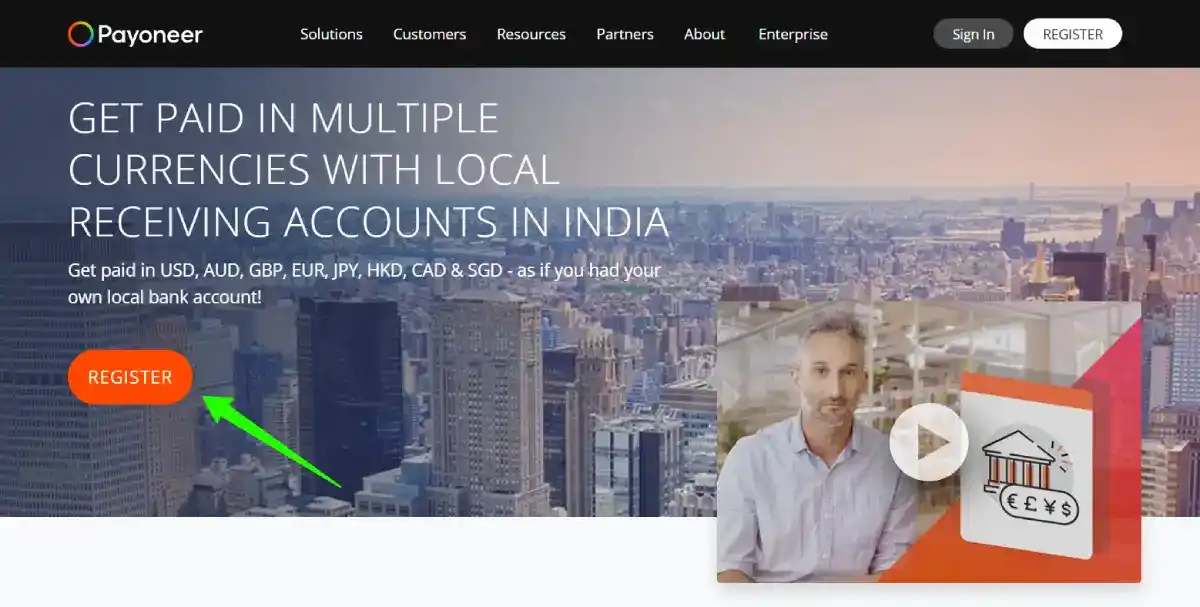

Receive international payment in a local bank account

Global Payment Service enables you to receive international payments from international brands in the US, UK, EU, Japan, Canada, Australia, and Mexico directly.

This reduces your payment fees by up to 71%. It is like having a local bank account to receive international payments at a cost-effective solution. You can receive payments from marketplaces globally directly into your bank account in minutes in INR at a low cost.

Pay VAT at zero fees

Yes, you heard it right!

Now, with your Payoneer account, you can pay VAT authorities in the EU and UK in GBP and EUR currencies at no additional cost. You save everything!

The process of paying VAT is quite simple. Just collect the payment details that include the amount, VAT number, country, and your Payoneer ID.

Email all the details to vat-in@payoneer.com and Payoneer will ensure your VAT payment is made securely. You have peace of mind as everything has been taken care of.

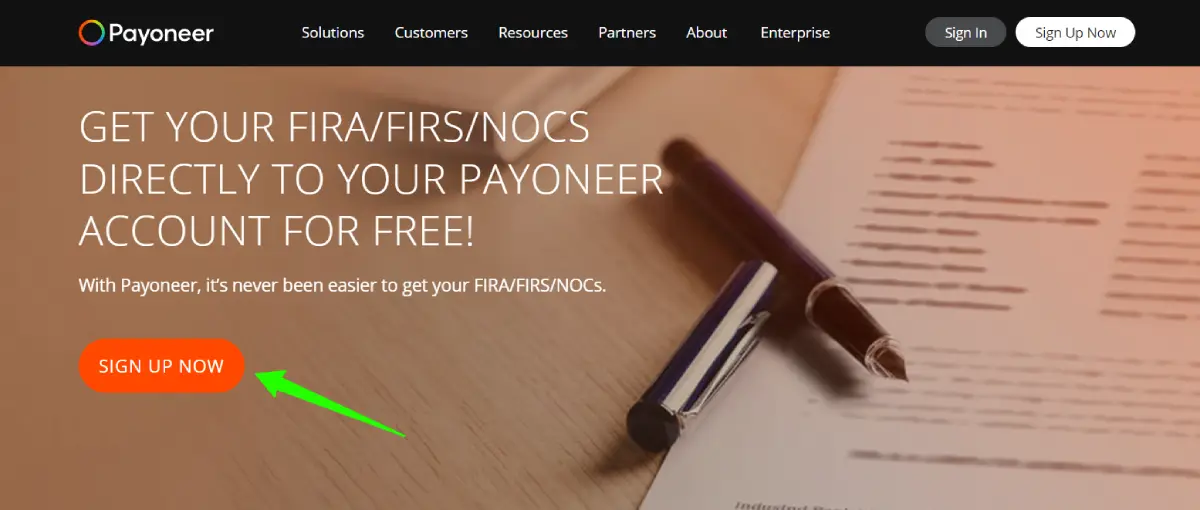

Automated Digital FIRC

FIRC stands for Foreign Inward Remittance Certificate which applies to those who receive payments from abroad in India. With automated digital FIRC, you don’t have to process any manual request or pay high fees.

Usually, it takes 72 hours from bank transfer so you will be notified when your digital FIRCs are available. Once you are notified of the new digital FIRC in your account, you can click and download it for your records.

How to send/receive money with Payoneer?

Simply sign up to Payoneer without any fees. It’s completely free!

After you have registered with all the information fed into your account including your bank details, you can start your business.

Now that you have verified your account, you can receive money in your Payoneer account. Then, transfer it to your bank account.

How much does Payoneer charge for the transfer of funds?

To know the fee structure, you have to understand the charges levied while getting paid and while withdrawing to your local bank.

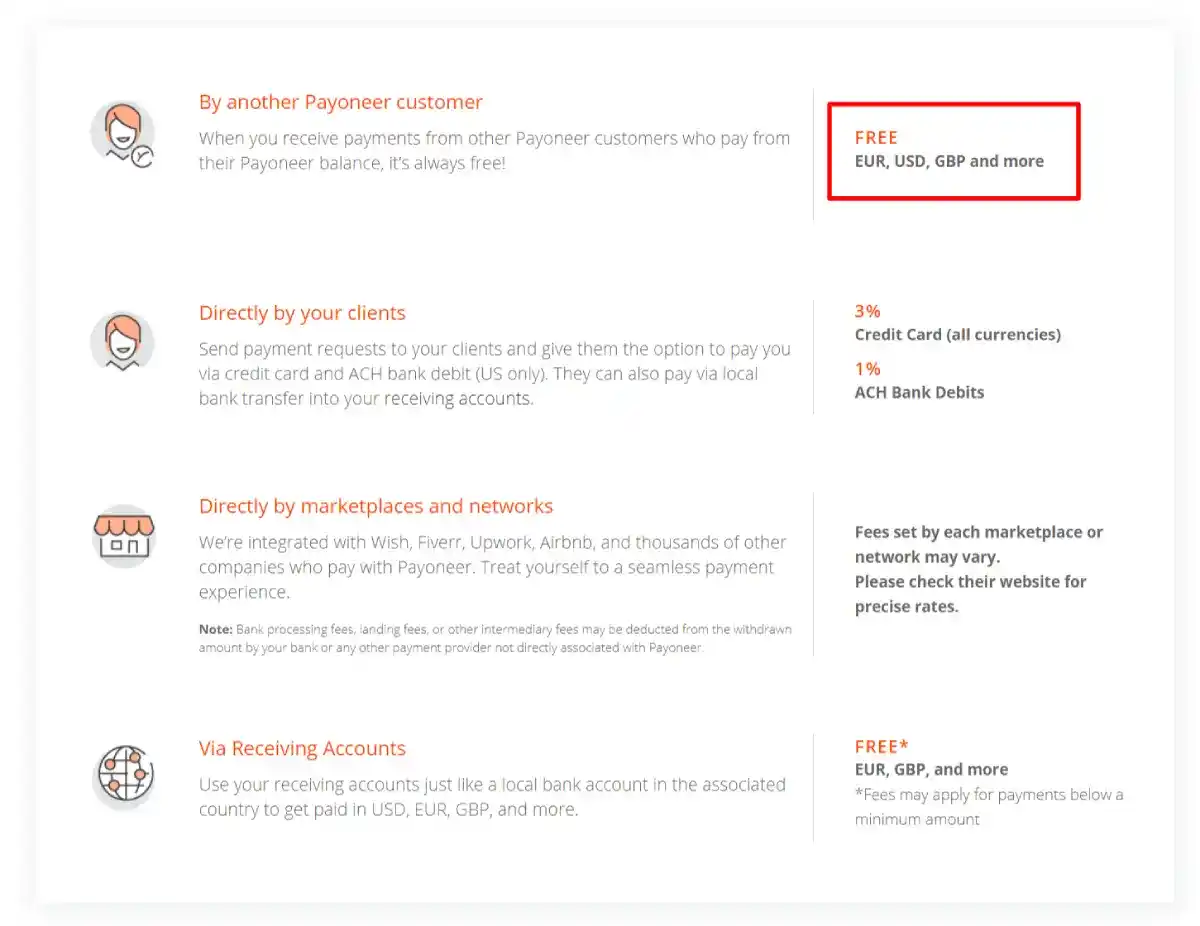

Fees for getting paid:

When receiving payments from one Payoneer account to another, you won’t be charged any fee. It is completely free!

Payoneer does not charge any fees when receiving funds in the local account given by Payoneer.

If you are requesting payment from customers directly using the My Account service, you will be charged 3% on a credit card in all currencies.

If receiving payments from any marketplace or companies that use Payoneer, you should check their websites for fee variations. When receiving funds like this, your bank may charge you additional fees that would be deducted from your received funds.

Fees for Withdrawing To Your Local Bank Account:

You will be charged 2% above the market rate at the time of the transaction when withdrawing funds from your Payoneer account to your local bank account.

Read More Reviews

Payoneer Review Conclusion: Is Payoneer Legit?

Till now there haven’t been any fraud cases notified by customers and is considered to be one of the safest platforms.

While there are other big platforms already in the market Payoneer is never on the downside.

If you compare Payoneer vs PayPal, you won’t find a lot of differences except that PayPal had the footprints in starting online banking systems in the ’90s and is therefore the most recognized brand.

When it comes to customer support Payoneer Live Chat support along with phone and email is available around the clock.

Time to leverage your time and money by choosing the fastest, simplest, and most flexible online transaction platform- Payoneer.

I hope the Payoneer review helped explain how you could save money on sending/receiving international payments in over 200+ countries/territories.

Till then…

Be Healthy, Be Wise, and Keep Sharing!

Take Care Reborns

🌟 FAQs | Payoneer Review

Is Payoneer free?

Payments revived by another Payoneer customer from Payoneer balance is free.

Is it safe to use Payoneer for international transactions?

Payoneer has multi-jurisdictional licenses and compliances. This ensures your money is in safe hands and protects your transactions from fraudulent activities such as money laundering.

In which countries is Payoneer licensed?

Payoneer is operational internationally and has licenses in Japan, Europe, India, the UK, Hong Kong, and Australia.

Which is better PayPal or Payoneer?

Both PayPal and Payoneer charge fees for withdrawing the amount to a local bank account. Payoneer transaction fee is a bit low but considering PayPal’s popularity, it somehow wins over Payoneer.

![Honest Payoneer Review [year]: Best PayPal Alternative? 1 payoneer review](https://affreborn.com/wp-content/uploads/2020/07/payoneer-review.webp)

![DesignEvo Free Logo Maker Review [year]: Best Online Logos 2 designevo review](https://affreborn.com/wp-content/uploads/2022/11/designevo-review-320x200.webp)

![Rank Math Affiliate Program Review [year]: Earn 30% + Bonus 3 rank math affiliate program review](https://affreborn.com/wp-content/uploads/2024/04/rank-math-affiliate-program-review-320x200.webp)

![AdTargeting Review [year]: Best Keyword Targeting Tool 4 adtargeting review](https://affreborn.com/wp-content/uploads/2022/10/adtargeting-review-320x200.webp)

![FlexClip Review [year]: The Best Free Online Video Editor 5 flexclip review](https://affreborn.com/wp-content/uploads/2022/02/flexclip-review-320x200.webp)

![How To Leverage Semrush Good Content Free AI Content Marketing Tools In [year]? 6 semrush good content free ai content marketing tools](https://affreborn.com/wp-content/uploads/2024/05/semrush-good-content-free-ai-content-marketing-tools-320x200.jpg)

![GoDaddy Hosting Review [year]: Best Low-Cost Web Hosting 7 godaddy hosting review](https://affreborn.com/wp-content/uploads/2020/03/godaddy-hosting-review-320x200.webp)