Mixed opinions are coming up after the big news from the Indian Government on Crypto TDS in India.

From July 2022, The Finance Ministry of India has introduced TDS on Cryptocurrencies. Crypto is considered a virtual digital asset (VDA). TDS on crypto will be levied on every transaction from July 1st, 2022.

Now you will receive 1% less value of the crypto assets on selling. This might be shocking news for crypto traders and especially for those who don’t file their ITR.

The good news is that if you file your ITR, you can claim a TDS refund. Let us learn more about the Crypto TDS in India.

Table of Contents

Everything You Need To Know About Crypto TDS In India

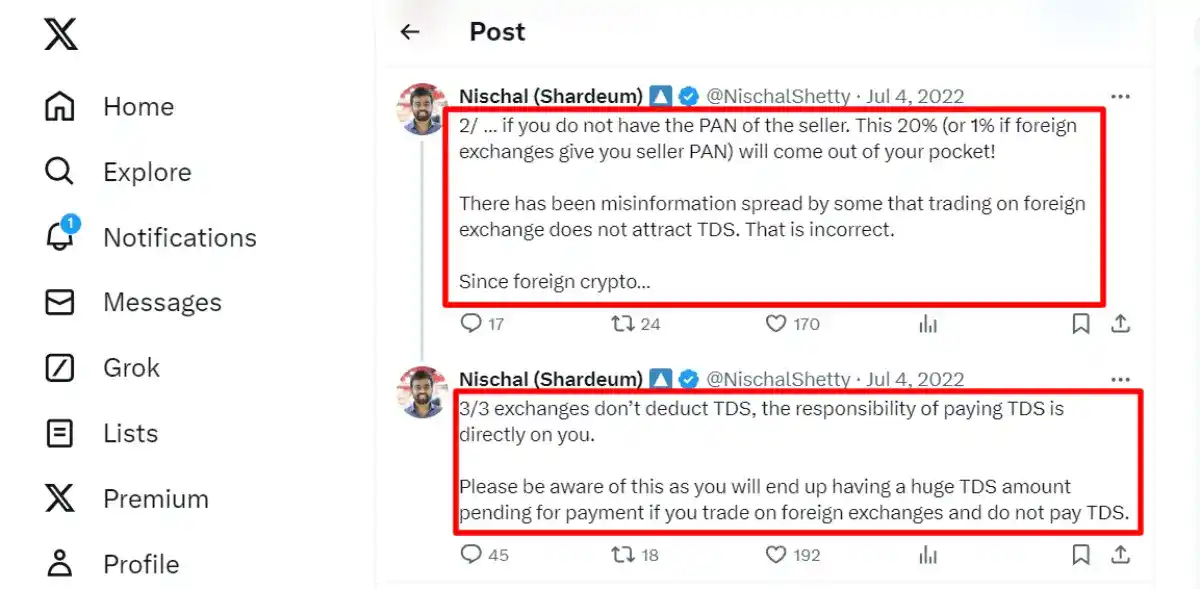

There are false rumors about TDS on crypto, but this Tweet from WazirX founder Nishal Shetty will clear your doubts about Crypto TDS.

Here are some facts on Crypto TDS simplified by Nishal Shetty:

- If you are trading on Forex that does not deduct TDS, then you must pay 20% Tax. You should know the PAN of the seller on International Exchanges.

- Some people are spreading false rumors and creating a misconception that Foreign exchanges do not attract TDS. That’s not true!

- If you do not pay TDS from your pocket, it will pile up and you will be answerable to the Government agencies.

- WazirX simplifies TDS on Crypto by deducting 1% TDS on every transaction. So when you sell any crypto like Bitcoin, Ethereum, Cardano, Matic, Shiba Inu, or more, a 1% TDS automatically gets deducted. So, you receive 1% less value of the sale amount

In which section of the Income Tax Act will the TDS get deducted?

The Finance Bill of 2022 clarified and declared that TDS under section 194S of the Income Tax Act, 1961 will be levied. (Source: Cleartax)

The Central Board of Direct Taxes (CBDT) has clarified that even for P2P transactions, 1% Crypto TDS in India is to be deducted under section 194S of the Income-Tax Act, 1961.

Note: Crypto TDS in India will be levied if you have made transactions on or after the 1st of July, 2022. For any transactions before 1st July 2022, TDS won’t be deducted.

But if you had placed orders before 1st July and the transactions appeared after 1st July, then you will fall under TDS provisions.

How Crypto TDS in India will be deducted from the WazirX Exchange?

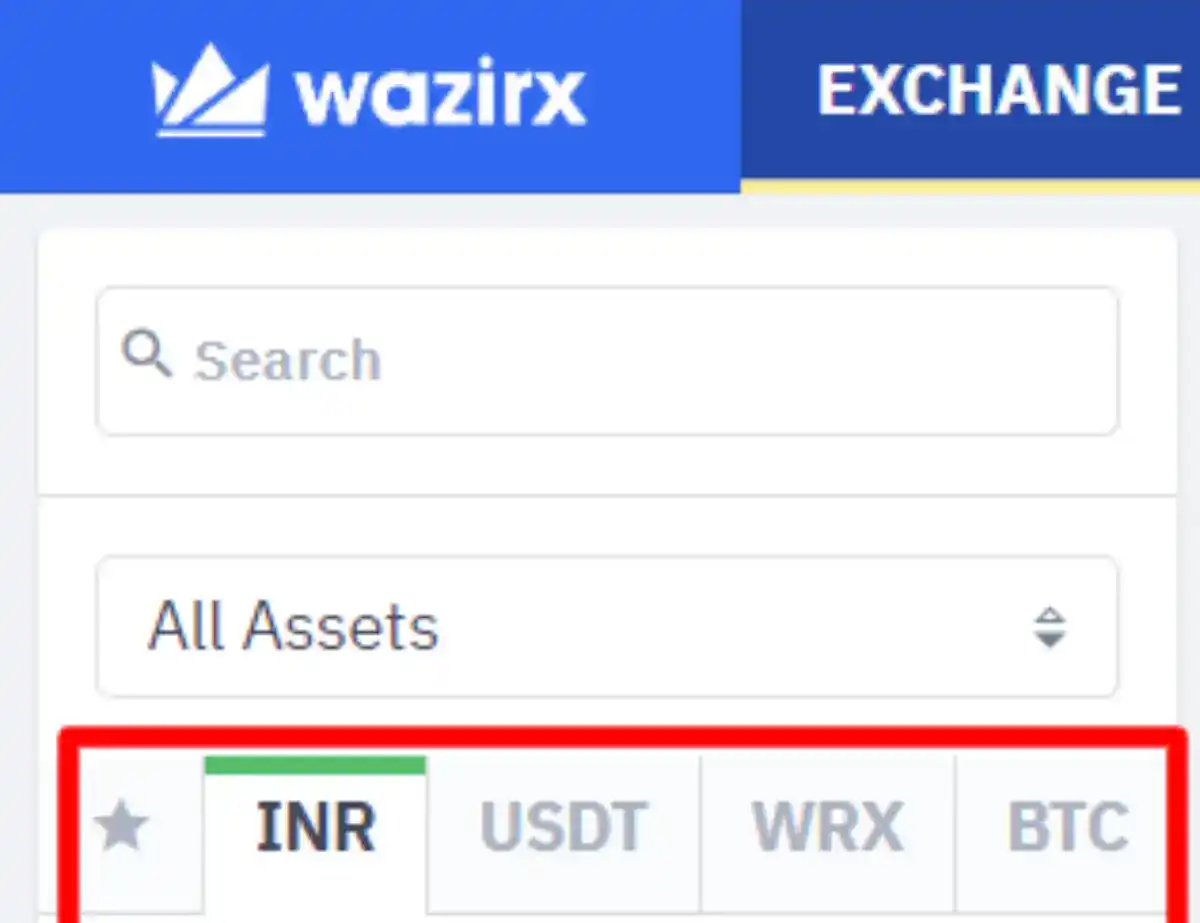

WazirX right now has four quote assets – INR, USDT, BTC, and WRX. TDS is not levied on the buyer buying crypto in INR. But when a trader sells crypto, TDS will be levied.

➡️ When crypto is bought using another crypto i.e. trading crypto by using crypto, then TDS will be levied to both sides. As per the Income-Tax Act 206AB, if you haven’t filed your ITR for the last two years, then the TDS deducted would be 5%. In this post, we are discussing 1% TDS on sell value.

➡️ As we are talking about TDS for Indians, TDS has to be paid INR to the Income-tax department. Hence, any TDS collected in Crypto needs to be converted to INR and then submitted to the Income-Tax Department.

➡️ To reduce the price slippage, in crypto-to-crypto transactions, TDS gets deducted from the quote asset.

➡️ Let’s say you traded ETH-BTC, and ADA-BTC, then BTC is the quote asset. Hence TDS on both sides would be deducted in BTC. If 1 BTC is traded for 100 ETH, then the BTC buyer receives 99 BTC at 1% TDS, and the BTC seller receives 100 ETH by paying 1 BTC at 1% TDS.

➡️ If 1 BTC is traded for INR 100, then the BTC seller receives INR 99, whereas the BTC buyer receives full BTC. In this case, TDS is levied only on the seller while the buyer is exempted from TDS.

➡️ In P2P transactions carried through USDT, the USDT seller will be levied 1% TDS, whereas the buyer does not need to pay any TDS. When a seller places an order of 100 USDT, after 1% TDS, an order of 99 USDT is placed.

➡️ Now, when a buyer places an order, the amount would not be 100 USDT, instead, it would be 99 USDT. So 99 USDT gets converted into INR and is transferred to the seller.

➡️ Let’s assume that the entire 99 USDT is not sold. In this case, 1% TDS is deducted in proportion to the amount sold. The remaining 1 USDT is locked for TDS and returned to the seller on order cancellation.

Conclusion: My Final Thoughts on Crypto TDS In India

How do you calculate crypto gains?

The simplest way to calculate Crypto gains is by subtracting the selling price (S.P) from the cost price (C.P). Sell price (s.p) – Cost price (c.p) = capital gain or loss.

I hope you guys understood about Crypto TDS in this article. I will keep you guys updated with the Crypto industry regularly.

With a plethora of crypto exchange platforms now available in India, WazirX is the #1 platform.

Do you know you can make money with the cryptocurrencies affiliate program?

Happy Cryptoing!

#wazirxwarriors #IndiaWantsCrypto

🌟 FAQs | Crypto TDS In India

How is TDS calculated on crypto?

As per section 194S of the Income-Tax Act, Foreign exchanges need to deduct 1% TDS on crypto transactions for Indians. The 1% TDS is applicable even on P2P transactions.

What is TDS on crypto in India?

Crypto is considered a virtual digital asset (VDA), and a VDA falls under TDS. The Government of India had already announced a 30% tax on cryptocurrency gains followed by 1% TDS on transactions applicable from the 1st of July, 2022.

How can you claim a TDS refund?

Claiming a TDS refund is not everyone’s cup of tea as it requires understanding the Income Tax Act. You need to consult a Chartered Accountant who will help you in filing your ITR and claiming a TDS refund.

![Crypto TDS In India [year]: Best Explained 1% TDS Deduction 1 crypto tds in india](https://affreborn.com/wp-content/uploads/2022/07/crypto-tds-in-india.webp)

![My Honest Push.House Review [year] (Best Push Ads Network) 2 push.house review](https://affreborn.com/wp-content/uploads/2023/08/push-house-review-320x200.webp)

![Honest Zoviz Review [year]: One-Click Premium Logo Designing Tool 3 zoviz review ai logo maker](https://affreborn.com/wp-content/uploads/2025/01/zoviz-review-ai-logo-maker-320x200.webp)

![BigSpy Review [year]: Best Ad Spying Tool 4 bigspy review](https://affreborn.com/wp-content/uploads/2022/12/bigspy-review-320x200.webp)

![Honest CandyOffers Review [year]: Best CPA Affiliate Program 5 candyoffers review](https://affreborn.com/wp-content/uploads/2022/02/candyoffers-review-320x200.webp)

![GoDaddy Hosting Review [year]: Best Low-Cost Web Hosting 6 godaddy hosting review](https://affreborn.com/wp-content/uploads/2020/03/godaddy-hosting-review-320x200.webp)

![XM Affiliate Program Review [year] XM Referral Commissions, Payouts & Global Reach 7 xm affiliate program review](https://affreborn.com/wp-content/uploads/2025/08/xm-affiliate-program-review-320x200.webp)